Jamie Ren

I am passionate about working with data to extract insights, build software, and develop ML models that enhance decision-making and recommendations

Data Scientist

I am eager to apply my quant finance background to data science, where I can help companies develop outstanding digital products for customers. I have experience:

- Designing and implementing large-scale recommender systems

- Building end-to-end data pipelines and analytics tools

- Applying ML techniques to construct predictive models

Tech stack Python (numpy, pandas, scikit-learn, matplotlib, seaborn, tkinter, regex, beautiful soup), SQL

Education

Carnegie Mellon University | M.S. Computational Finance (Dec 2024)

New York University | B.A. Mathematics, B.S. Business (May 2023)

Work Experience

Qube Research & Technologies

Quant Research Intern (Feb – Apr 2025)

- Constructed 4 high-frequency strategies using microstructure tick data to predict forward returns in crypto futures

- Applied hypothesis testing across 250 crypto products over 15-month period to verify proposed implementation outperforms existing one

- Built dashboard pipeline to visualize strategy performance (PnL, Sharpe ratio, signal vs return regression, autocorrelation, etc.).

Squarepoint Capital

Quant Research Intern (Jun – Aug 2024)

- Implemented Bloomberg chat parser that maps broker quotes to securities using regex with >90% recall and >95% accuracy

- Ran parser on 120k+ messages over 65 days to provide novel insights on trade flow and broker selection

- Created daily automated dashboard that aggregates raw trade data into detailed yet easy-to-read report for senior management

Projects

Book Recommender with GoodReads Scraper

- Personalized recommender using data collected with parallelized BeautifulSoup scraper (16K+ books, 175K+ users, 470K+ ratings)

- Utilizes collaborative filtering to generate recs from top 50 similar readers based on user’s book ratings and genre preferences

- Produces high-quality recommendations in <10 seconds by pulling personal Goodreads data from inputted user_ID

- Full-stack project covering data engineering, product design, and ML techniques

Yield Curve Modeling with Nelson-Siegel + Linear Regression

- Applied parametric dimension reduction to transform US Treasury yield curve data spanning 20 years to time series of (β₁, β₂, β₃)

- Analyzed regression results of macroeconomic variables on these new response features vs. OLS on original yield curve values

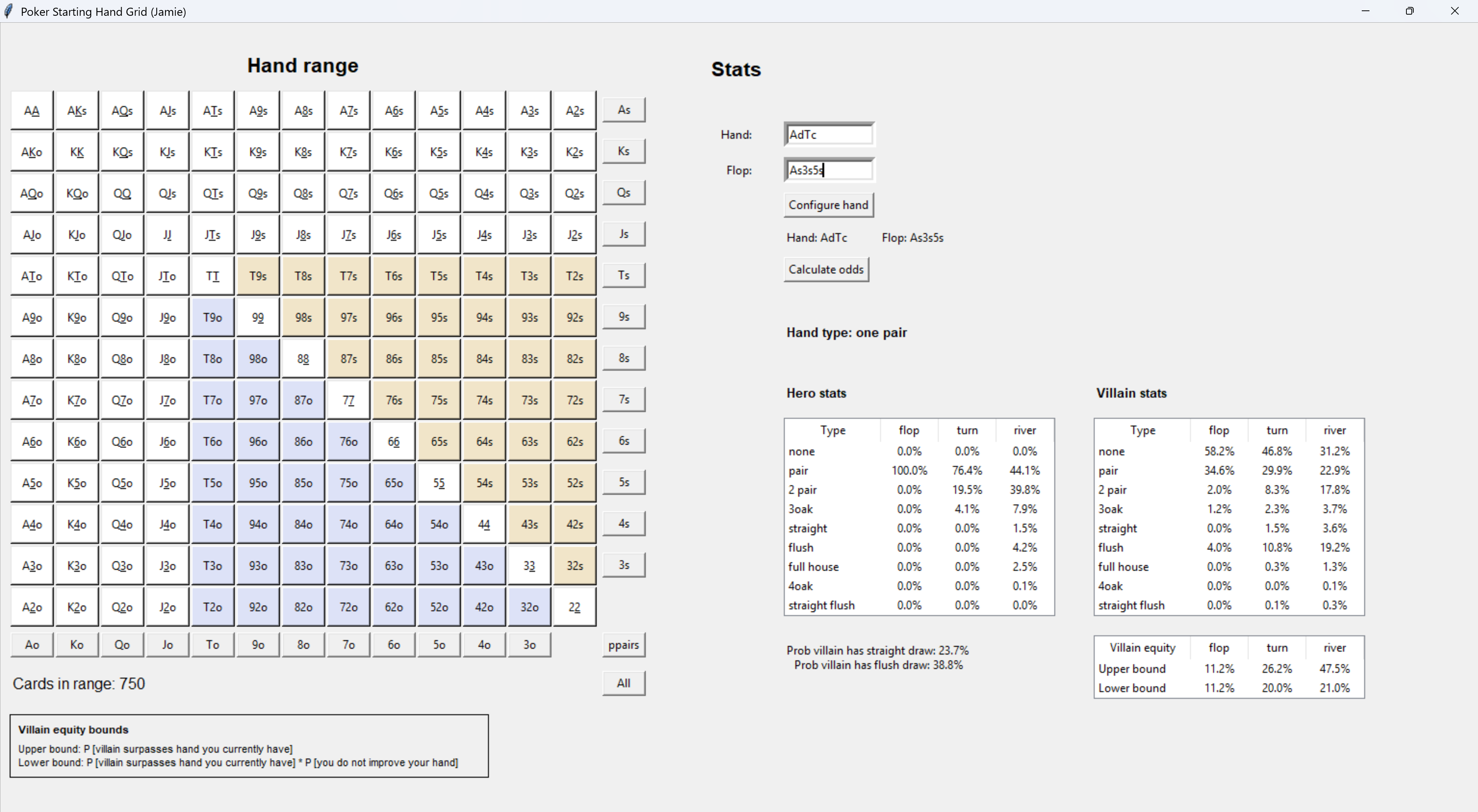

Poker Hand vs Range Probability Tool

- Built Python app with GUI that displays real-time poker analytics, including exact hand probabilities, and win odds

- Processes user-inputted cards, flop, and opponent’s range assumptions to calculate statistics in <0.2 seconds